Company Name:

Incubation Round:

Application Track:

Proposed by:

YKT

Data Provider:

YKT

Challenge Name:

Product Description

Brain will extend its existing proprietary Machine Learning and Natural Language Processing platform to create a product aimed at the early detection of Non Performing Loans for small and medium enterprises. The system will combine structured and unstructured financial data for for small and medium enterprises also including external data, for example economic and market conditions indicators.

The engine will be dynamic in the inclusion of features and will keep track of the most relevant ones, therefore creating an intelligible model as opposed to a ‘black-box’ system. The individuation of the most relevant factors contributing to the default probability and their dependence from external conditions will allow to create a dynamic scorecard for the evaluation of new applications for credit.

- Use of Model–view–controller (MVC) as a software design pattern to divide the software into three separate but interconnected elements (data model, user interface and computational model) to facilitate the interoperability of the appliction with external systems.

- Use of RestAPI protocol to standardize the backend communication with user interface and external systems

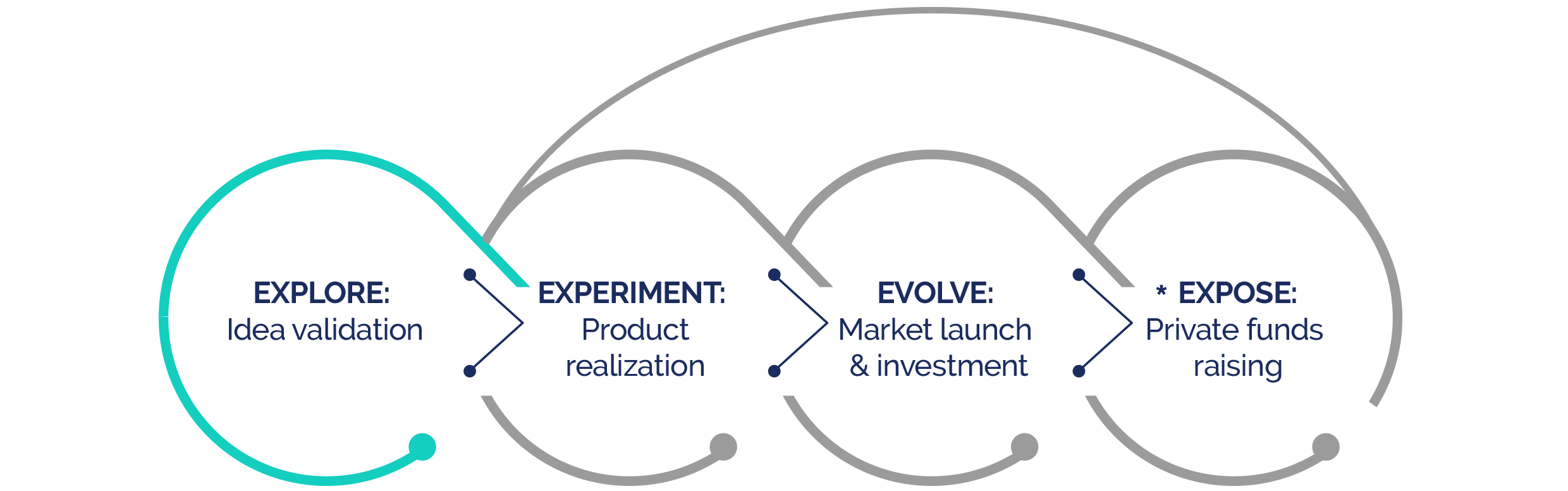

*Expose phase is open to all Experiment phase teams

Location:

Sector:

Website:

Company maturity:

Investment level:

Funding raised:

Collaboration opportunity:

Company Description

Brain is actively using the OpenFigi symbology in the context of Finance for identifying and mapping financial assets. This platform provides an unique identifier for each asset and it can eliminate redundant mapping processes and reduce operational risk.

Matteo Campellone

Theoretical Physicist in complex systems, covered various roles in Finance (Risk Management, Financial Modelling, Chief Investment Officer and CEO). MBA and PhD.

Francesco Cricchio

Theoretical Physicist expert in solving complex computational problems in various industrial sectors with focus on Finance.

Alessandro Sellerio

Physicist with broad expertise in the field of complex systems and computational problems and strong expertise on software engineering.

Pietro Russo

Economist skilled in quantitative methods and past research on bankruptcy prediction.