Company Name:

Incubation Round:

Application Track:

Proposed by:

YAPI KREDI TEKNOLOJİ (YKT)

Data Provider:

YAPI KREDI TEKNOLOJİ (YKT)

Challenge Name:

Product Description

The product is an AI-powered platform that helps financial institutions detect non-performing loans for both existing and new corporate clients. By screening corporate clients combining fundamental analysis and machine learning techniques, the platform can identify non-performing loans with high accuracy. It provides a probability of default for each client and allows financial institutions to take corrective action before the loans turn into defaults.

What sets this platform apart is its ability to make accurate predictions for new clients using transfer learning. This means that the platform can leverage data from existing clients to make predictions for new ones, especially when there is limited data available for the new clients. With this innovative approach, financial institutions can minimise the risk of non-performing loans and improve their overall portfolio performance.

Usage of Standards for data interoperability:

The AI platform for non-performing loan detection is designed to be highly interoperable, enabling financial institutions to easily integrate it into their existing systems and workflows. The platform is self-embedded and cloud-based, making it easy to deploy and scale as needed. Financial institutions simply need to share specific client data with the provider, and the platform’s model can run predictions independently, conforming with all GDPR rules and regulations.

By leveraging industry-standard data formats and protocols, the platform enables seamless data interoperability, ensuring that clients can get the most accurate and up-to-date predictions possible, while maintaining the highest levels of data privacy and security. The platform’s ease of use and self-embedded design make it an ideal solution for financial institutions looking to streamline their loan detection processes, while still maintaining the highest levels of data quality and accuracy.

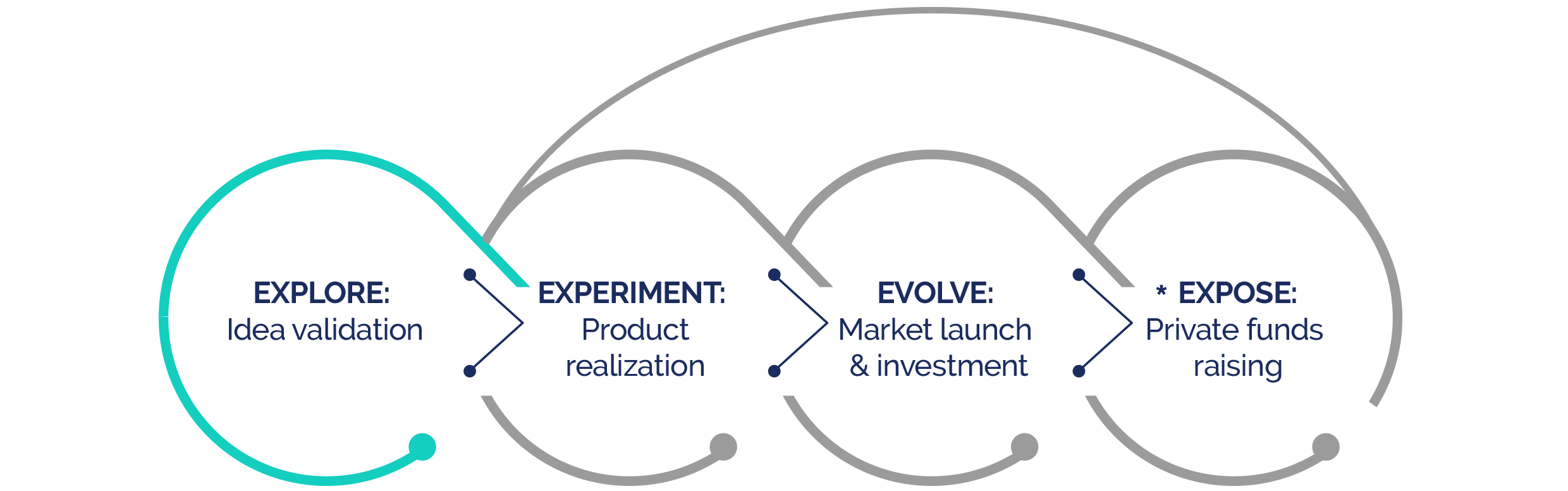

*Expose phase is open to all Experiment phase teams

Location:

Sector:

Website:

Company maturity:

Investment level:

Funding raised:

Collaboration opportunity:

Company Description

Finclude develops a unique pan-European credit scoring system that allows businesses to assess consumers in a universal way based on their transactional behaviour, regardless if they have a credit history or not.

Ioanna Stanegloudi

Ioanna has 21 years experience in banking & management consulting. Expertise in credit risk, financial modelling & analytics for corporations and consumers.

Yiannis Giokas

Yiannis has more than 14 years of experience in cybersecurity, big data & telecoms. He develops data driven products in these areas.

Michalis Papasymeon

Michalis is an experienced Data Engineer with a strong Software background. He has worked on projects related to Telecom & Banking data.

Panayotis Papoutsis

Panayotis (PhD) is an expert data scientist. Applies statistical & ML tools with the latest tech innovations & ethics. Analyses behavioural patterns.