Company Name:

Incubation Round:

Application Track:

Challenge Name:

Product Description

The Divizend Actor will be the foundation for a revolutionary new financial data ecosystem. Through the innovative analyses published on the Actor Marketplace, access to high quality financial markets data will be offered, especially based on companies’ financial reports. These analyses will help private investors make better and more informed investment decisions.

Due to the marketplace model, highly sophisticated applications can be published by anyone without additional development cost for Divizend. Possible ideas include:

- presenting and comparing core financial metrics in graphical form

- personalized stock market data/performance calculation based on user preferences

- tools to filter stocks based on market capitalization, industry segments, currency, etc.

- dividend income cash flow analysis

- AI-based solutions (recommendation engines, portfolio performance forecasting, etc.)

Usage of Standards for data interoperability:

- specific to the financial and regulatory sector: parsing ESEF-compliant annual reports from EU-based companies (uses XHTML/iXBRL), Open Banking APIs (incl. PSD2, OpenWealth, FinTS), digital signatures

- general IT standards: NoSQL databases Neo4j and MongoDB, OAuth2, Node.js and React, Kubernetes and Docker, git/GitLab

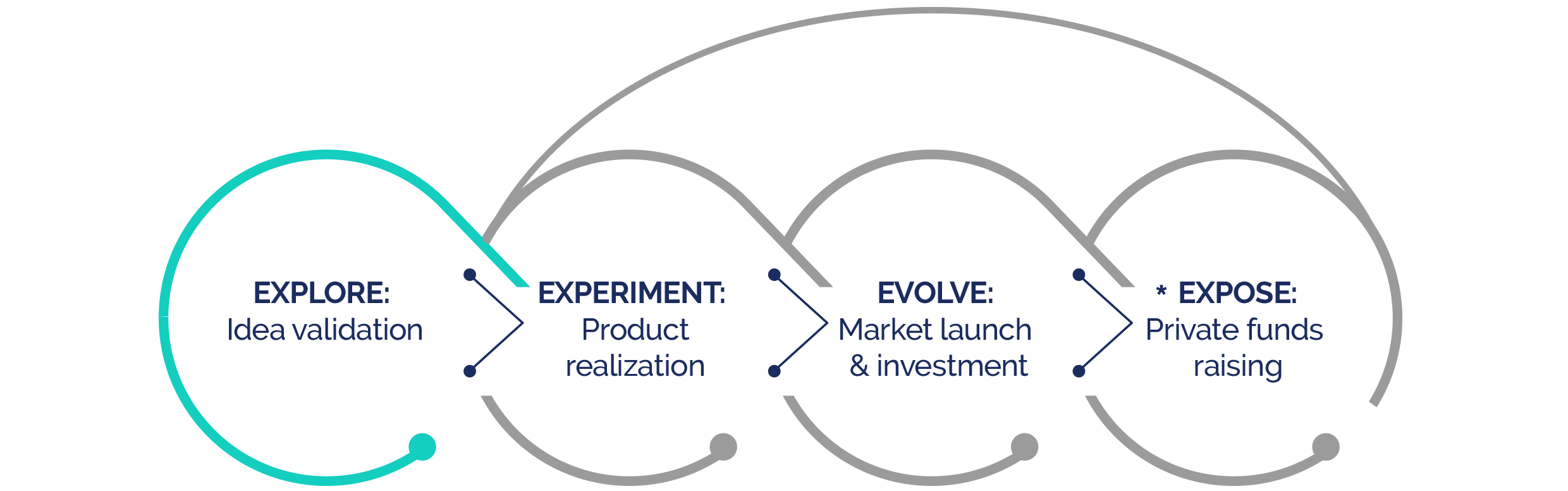

*Expose phase is open to all Experiment phase teams

Location:

Sector:

Website:

Company maturity:

Investment level:

Funding raised:

Collaboration opportunity:

Company Description

Involvement in Standardisation Bodies:

- Swiss OpenWealth Association

Thomas Rappold

CEO with 20 years FinTech experience (Allianz, Credit Suisse), co-founder Numbrs, WealthTech, PSD2, bestselling author, frequently in TV/newspapers.

Julian Nalenz

CTO, main software architect, highly active in Munich start-up scene, active GitHub contributor, experience in Machine Learning.