Company Name:

Incubation Round:

Application Track:

Proposed by:

YKT

Data Provider:

YKT

Challenge Name:

Product Description

Despite their economic importance, SMEs are the business units that report the least financial information. Banks and financial institutions only have transactional financial information available to them when they are their integral clients and only 25% of SMEs are integral clients of a single bank. This means a large dispersion of information between different financial institutions. The proposal involves a substantial innovation in three aspects: obtaining information from SMEs that is relevant for the prediction of default, computational efficiency so that these predictions can be carried out in real-time, and thirdly, the differential use of algorithmic models and machine learning.

Data collection. The use of financial data is not differential and is incomplete, the proposal proposes to study the influence of sociodemographic data and digital footprint data on the internet of these companies.

Computing. Wenalyze has developed a fast and scalable database system platform that combines the characteristics of SQL and NoSQL low latency and performs SQL & GIS queries at any scale. It is built to ingest massive batch and real-time data pipelines and make it available through SQL or GIS for any use, such as operational applications, analytics, dashboarding, or machine learning processing.

Algorithm and ML. The data obtained will be analyzed using Machine Learning techniques to obtain patterns that can be used to find common data in companies that have previously defaulted. To get better results, synthetic data will be used in those companies that have less information obtained from the original financial and non-financial data, thus increasing the density of analyzable data and increasing the chances of better results.

This indicator will be updated in real-time with each change in financial or market information that occurs in the company or its environment. In this way, in the event of any unforeseen event, there will be an early warning of changes in the company’s risk, allowing the corresponding institution to act and reducing the company’s risks.

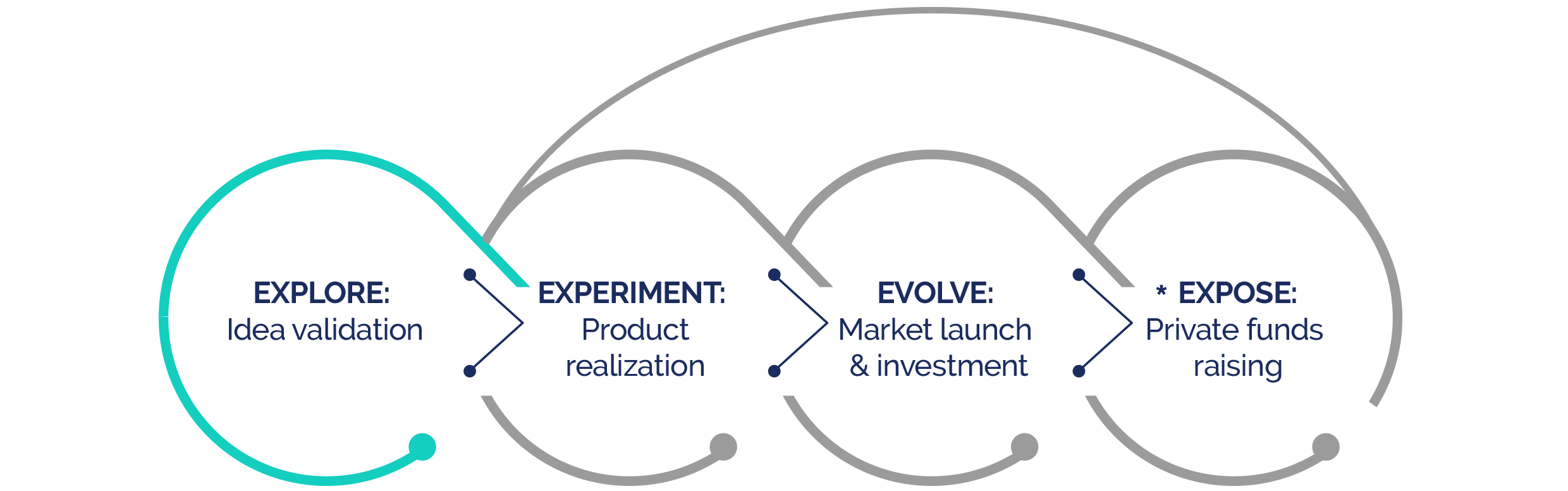

*Expose phase is open to all Experiment phase teams

Location:

Sector:

Website:

Company maturity:

Investment level:

Funding raised:

Collaboration opportunity:

Company Description

Carlos Albo

CEO & Project Manager for REACH (Business). Economist and intelligence analyst, more than 20 years of experience in technology and financial sector.

Vicent Sebastiá

CTO (Technical) Highly experienced in software development DDBB, Architecture, Design, Implementation, Version Control and Algorithms, expert in AWS big data management.

Rebeca Jimenez

CDO (Technical) Specialized in machine learning and statistical analysis. Rebeca has developed analytical models in different financial projects in Spain and Latin America, applying statistics and econometrics to develop business solutions.

David Delgado

CFO & Banking expert (Technical)David has 20 years of experience in corporate consulting, auditing and banking. He is expert in European Central Bank reporting.

Roger Ferrandis

CBO & Sales (Business) has worked in the insurance industry for the last 6 years mixing roles as consultant and chief operating officer. He will take care for the business development and sales.